View:

May 15, 2024

Asia Open - Overnight Highlights

May 15, 2024 12:00 AM UTC

EMERGING ASIA

EM currencies perform individually against the USD as the greenback yo-yo on stronger PPI and Fed speaker's comment. THB saw the largest gains of 0.41%, followed by MYR 0.25%, SGD 0.13%, PHP 0.04% and INR 0.02%; the biggest losers are IDR 0.12%, KRW 0.07% and TWD 0.02%.

USD/CNH is tradin

May 14, 2024

Preview: Due May 24 - U.S. April Durable Goods Orders - Underlying trend remains near flat

May 14, 2024 6:01 PM UTC

We expect April durable goods orders to fall by 0.8% after a rise of 0.9% in March (after annual revisions were released on May 14) with a 0.3% increase ex transport to follow an unchanged March. Underlying trend remains close to flat.

Preview: Due May 22 - U.S. April Existing Home Sales - No signals for a strong move

May 14, 2024 3:29 PM UTC

We expect existing home sales to be unchanged at 4.19m in April, pausing after a 4.3% decline in March corrected a strong 9.5% increase in February. We expect to see trend move lower in the coming months, but there are no clear signals for a second straight decline in April.

BCB Minutes: Worsening Conditions Demand Caution

May 14, 2024 2:35 PM UTC

The Brazilian Central Bank's latest meeting revealed a shift in forward-guidance, reducing the cut from 50bps to 25bps. While no immediate actions were taken, the minutes highlighted worsening conditions in three key areas: External Environment, Fiscal, and Economic Activity. Despite split votes on

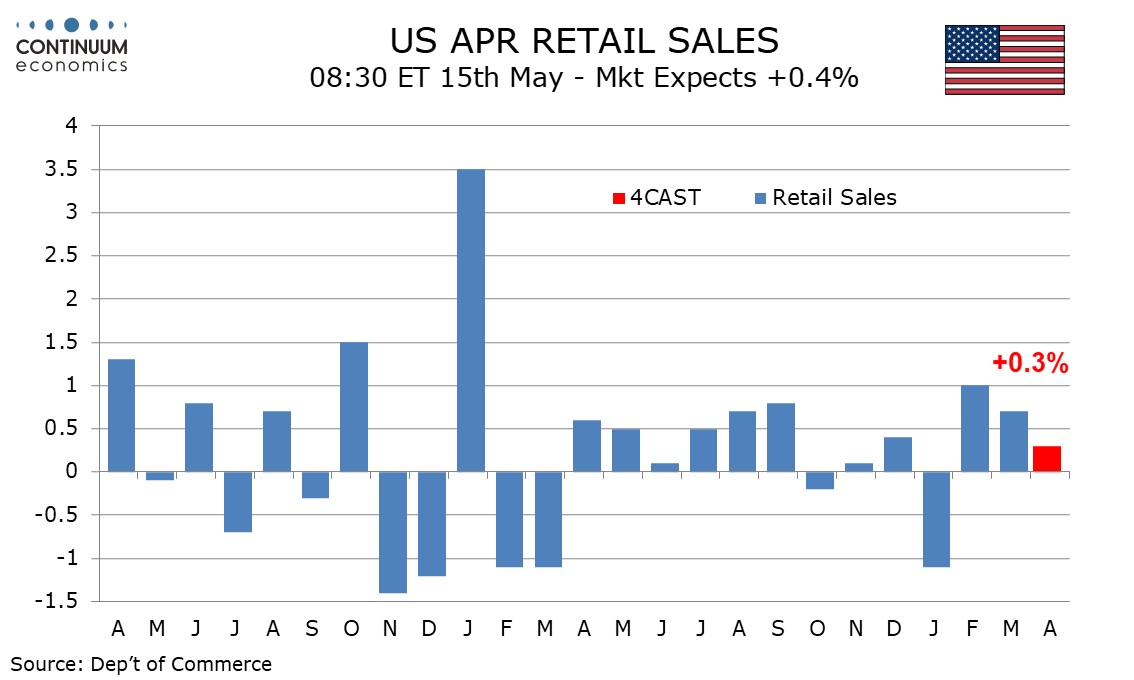

Preview: Due May 15 - U.S. April Retail Sales - Pause after a strong month

May 14, 2024 2:02 PM UTC

After a 0.7% increase in March, we expect April retail sales to rise by only 0.3%. Ex autos we expect a 0.2% increase to follow a 1.1% rise in March, while ex autos and gasoline we expect sales to be unchanged after a 1.0% increase in March which was the strongest since October 2022.

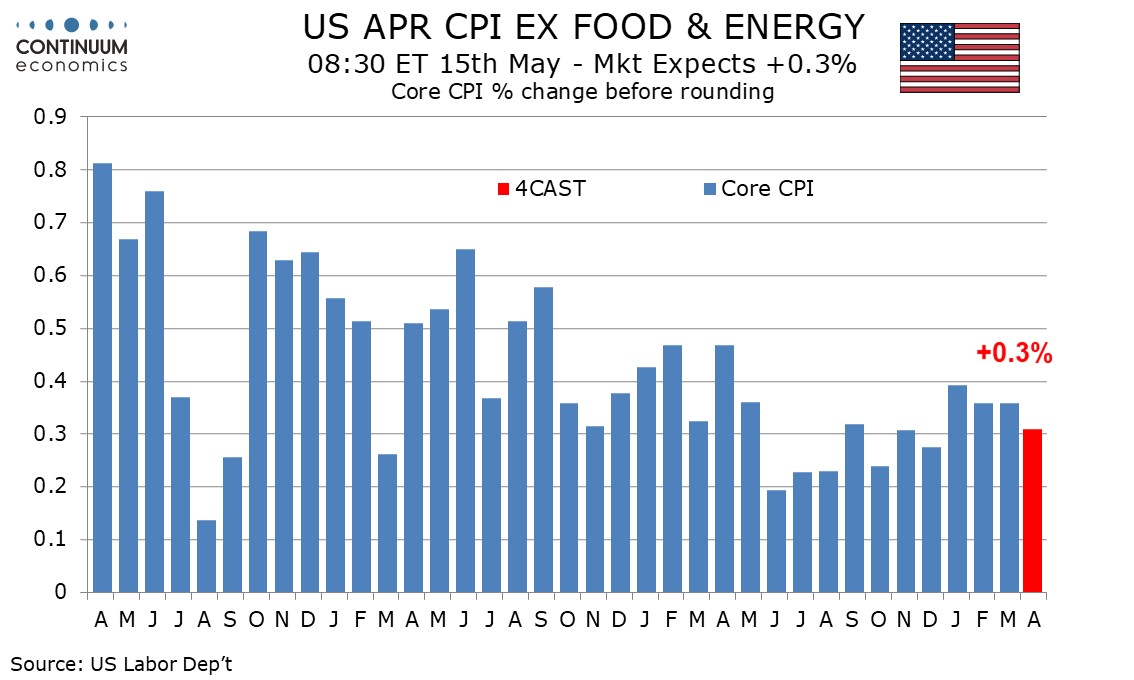

Preview: Due May 15 - U.S. April CPI - Core rate not quite as strong as the preceding three months

May 14, 2024 1:48 PM UTC

We expect April CPI to rise by 0.4% overall for a third straight month but with the ex food and energy pace slowing to 0.3% after three straight months at 0.4%. We expect the strong start to the year to fade as the year progresses, though April PPI strength was disappointing and inflationary pressur

U.S. April PPI - Worrying strength, even if surprise in part offset by March revision

May 14, 2024 1:17 PM UTC

April PPI surprised on the upside with gains of 0.5% overall and ex food and energy, with ex food, energy and trade up by 0.4%. The upside surprise is however largely offset by downward revisions to March, both overall and ex food and energy to -0.1% from +0.2%, though March ex food, energy and tr

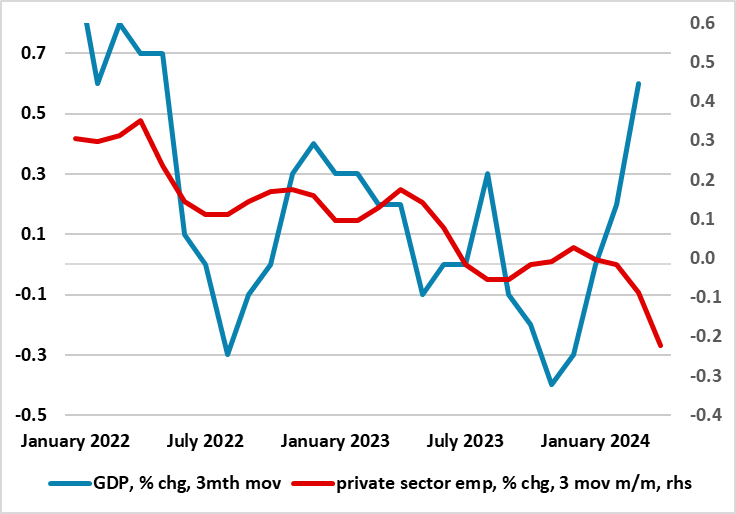

UK Labor Market: Further Signs of Resilient Wage Pressure But Soggier Activity More Notable

May 14, 2024 8:40 AM UTC

As we have underscored repeatedly, the BoE has come to regard the official ONS average earnings data with some suspicion given response rates to the surveys that have fallen towards just 10%. But the BoE will not be able to dismiss the latest earnings data given that alternative (and more author