View:

May 17, 2024

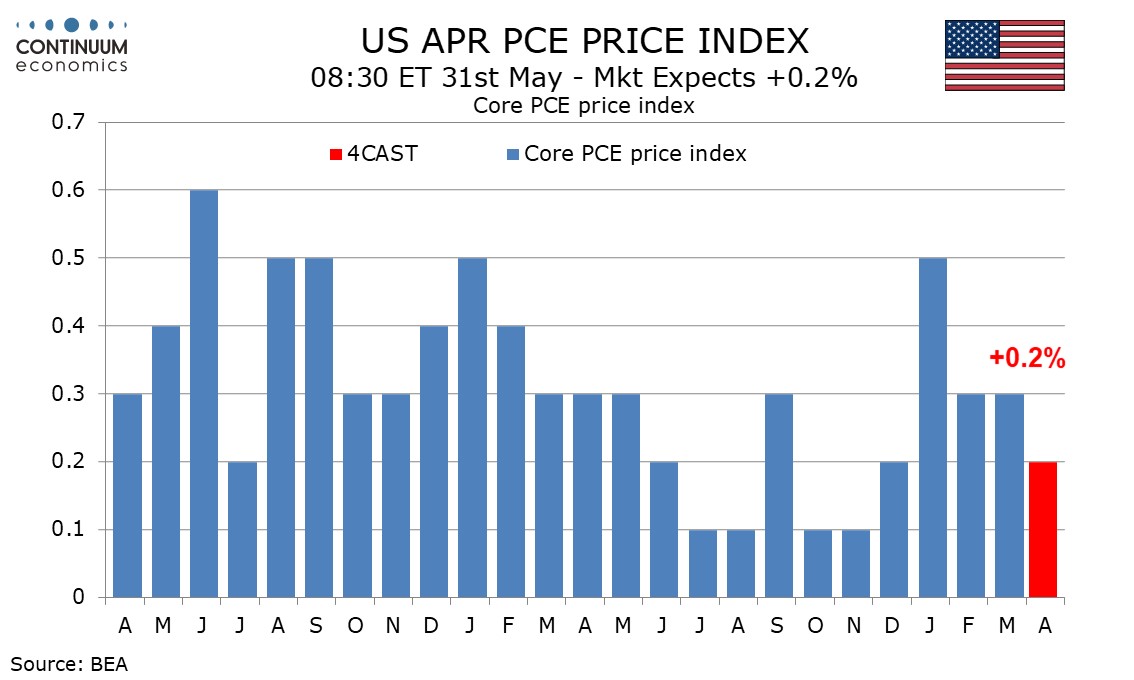

Preview: Due May 31 - U.S. April Personal Income and Spending - Core PCE Prices to round down to 0.2%

May 17, 2024 4:04 PM UTC

April’s core PCE price index looks set to come in close to 0.25% before rounding, though we expect the index to be rounded down to 0.2%, while overall PCE prices are rounded up to 0.3%. We expect a subdued 0.2% increase in personal income to underperform a 0.4% increase in personal spending.

May 16, 2024

U.S. April Industrial Production - Underlying picture looks flat

May 16, 2024 1:31 PM UTC

April industrial production was unchanged with a downward revision to March offset by an upward revision to February. Manufacturing was weak at -0.3% though outside a negative correction in autos the drop was only 0.1%, leaving a fairly flat underlying picture.

Brazil: Possible Impacts of the Floods

May 16, 2024 1:07 PM UTC

Unprecedented floods in Rio Grande do Sul, a state that contributes 6.4% to Brazil's GDP and 13.3% to its agricultural production, have submerged several cities. The immediate halt in economic activity may reduce Brazil's Q2 GDP by up to 0.4%. The federal government is increasing aid, potentially ra

U.S. Initial Claims, Housing Starts, Philly Fed - No real surprises but consistent with a modest slowing

May 16, 2024 1:00 PM UTC

The latest data is all close to consensus, initial claims partially correcting a sharp rise last week, housing starts correcting a sharp fall last month but permits seeing a second straight dip while the Philly Fed corrected from a strong preceding month but remains positive. All this is consisten